RBI Working Paper Series No. 01

Measuring Contagion Effects of Crude Oil Prices on Sectoral Stock Price Indices in India

Madhuchhanda Sahoo, Arvind Kumar Shrivastava, Jessica Maria Anthony and Thangzason Sonna@

Abstract

1This paper explores the contagion effects of extreme changes in global crude oil prices on sectoral stock price indices in India. Using generalised Pareto distribution (GPD) for estimating excess returns or exceedances i.e., deviations from thresholds, and multinomial logit model (MNL) for assessing the probability of contemporaneous excess returns or co-exceedances, the paper finds a significant likelihood of co-exceedances among 10 sectoral stock price indices when faced with extreme changes in global crude oil prices. This points to the existence of a contagion effect. The evidence of positive co-exceedances is stronger, and the results are found more robust when relevant control variables are introduced – exchange rate returns (INR-USD), 10-year G-sec yield, and differential stock returns, (i.e., small firms minus big firms (SMB)). The contagion effect on all sectoral indices, irrespective of their direct and indirect exposure to oil price dynamics, highlights the need for hedging by investors as mere diversification of portfolios may not be sufficient to protect their assets from an adverse oil price shock.

JEL classification: C32, G12, G15Key Words: Co-exceedances, Indian stock market sector, extreme values, multinomial logit

Introduction

The studies on contagion effects of extreme changes in global prices of crude oil on sectoral stock indices done in the Indian context are rare. There are not many studies on this subject even at the international level. The increasing cross-border financial integration warrants that the contagion effects of global prices of crude oil – one of the most actively traded commodities worldwide – on stock prices is understood better. For an oil-dependent economy like India, importing around 80 per cent of its consumption requirements, the need for a deeper understanding of the contagion effects of global crude oil prices is all the more pressing.

Oil has both commodity and financial attributes. As a commodity, while rising oil price increases the operating costs of firms leading to depressed stock prices, as a financial asset, when higher oil price is driven by higher demand expansion, it positively affects stock returns. Studies have observed that crude oil shocks can influence expected earnings in the equity markets, both within and across borders, while the macroeconomic impact of oil price shocks can also have ramifications for overall liquidity in the financial market.

Commensurate with being the second-largest country in the world in terms of population, the fifth-largest economy in the world, and third in Asia, India holds the distinction of being the third-largest consumer of oil, next only to China and the US. Likewise, India is the third-largest importer of crude oil after the US and China. Domestically, oil is the largest source of the country’s total energy supply next only to coal and also is the largest in terms of total final consumption. The demand for oil is increasing rapidly. Yet, owing to low natural endowment and stagnant domestic production, India’s reliance on imports for meeting the demand-supply gap is high. Also, the oil and gas sector is one of the six core industries in India and is among the most traded commodities. It is, therefore, natural that the implications of extreme changes in global prices of crude oil on the Indian macro economy would be profound. In the same vein, it may not be farfetched to expect movements in global prices of crude oil to impact Indian stock indices. More so because the Indian stock market has grown larger, and the Indian financial system is substantially integrated with the global financial system over the years.

In this backdrop, with the motivation to empirically examine the existence of contagion effect of extreme changes in global crude oil returns on 10 composite sectoral indices of Indian stock markets, the paper employs the multinomial logit model (MNL), as in Sheng Fang and Paul Egan (2018) for China. The threshold returns for global crude oil price and sectoral stock indices – both for the top and bottom tails, are established using a generalised Pareto distribution (GPD) function. Having established the thresholds, the MNL model is used to examine the probability of extreme returns or exceedances, defined as deviation from thresholds, contemporaneously occurring among the stock sectors due to exceedances in oil price returns, which the literature has defined as contagion effects.

The study has been organised into five sections. Section II presents the review of the literature and the stylised facts. Section III provides a detailed explanation of methodology, data, and preliminary analysis. Section IV reports and analyses the empirical results and Section V concludes the paper.

II. Review of Literature and Stylised Facts

II.1 Review of Literature

Hamilton (1983) discovered that crude oil price changes played a key role during every post-World War-II US recession. After his pioneer work, exploring the linkages between crude oil price and the real sectors of the economy has been a major area of theoretical and empirical research. Successive researchers investigated the association between oil price shocks and macroeconomic variables – economic growth, aggregate demand, inflation, and employment in various countries. The subsequent studies that followed, established without ambiguity that oil price shock has the potential to trigger cost-push inflation, adversely affecting profitability and causing generalised inflation. And if unchecked, it can engulf the whole economy, leading to higher unemployment, compressed demand, and consumption, discouraging investment, and a sustained growth slowdown.

Indeed, the crude oil price surge due to the Arab oil embargo was at the core of the global slowdown during 1974-75. The global Gross Domestic Product (GDP) grew by 6.9 per cent in 1973, fell to 2.1 per cent in 1974, and to 1.4 per cent in 1975. It was only by 1976 after the oil embargo that the world economy returned to its normal rate of growth. The US GDP contracted for three consecutive years during 1973-75 and unemployment and inflation rates more than doubled. So pervasive was the impact that it led to an aspersion on the foundation of Classical Economics, according to which inflation is always and everywhere a monetary phenomenon, and its off-shoot – the Philips Curve – which assumed a steady, permanent, and direct relationship between employment and inflation.

The studies on the relationship between volatility in crude oil price movements and stock indices have been relatively of a new vintage as compared to studies on the relationship between crude oil price movements and macroeconomic variables. The premise that the rise in performance of the stock market is a good indicator of economic activity, has existed all along as a perceived notion. In fact, this notion led to another perceived notion of the existence of a causal relationship between crude oil price and the stock market. Studies like Nasseh and Strauss (2000); Pethe and Karnik (2000); Singh (2010); Dhiman and Sahu (2010) have attempted to empirically examine the relationship between crude oil price and macroeconomic variables in different countries including India. Most studies observed a strong relationship between crude oil price movements and macroeconomic variables.

As regards crude oil price movements and stock markets, the empirical literature has been vast, and the findings thereof point mostly to an inverse relationship. There have, however, been a few studies that have found the relationship to be non-existent as well. Commonly, the relationship between the two markets has been analysed using (a) extreme returns on crude oil price, frequent fluctuations in crude oil prices, the net external trading position of the country in the global crude oil market (exporter or importer), and origin of crude oil price shocks (demand or supply-driven) on the one hand, and (b) overall returns or volatility of stock markets on the other, with relevant control variables like foreign currency exchange rate and interest rate.

A study on stock markets of the Gulf Cooperation Council (GCC) pointed out that negative oil price change had a larger negative impact on the stock markets of Kuwait, Oman, and Qatar which being oil exporting countries are relatively more responsive to the considerable oil price change (IMF WP, 2018). The stock markets of Latin American countries have been found to respond positively to increases in oil prices during 2000-2015 (Salgado et al., 2017). According to the authors, their finding can be explained based on regional closeness, shared institutional, historical and cultural features, and the way country-funds and regional-funds managers and other institutional investors who hold Latin American stocks react to oil price shocks.

Examining the differential impacts of fluctuations in crude oil prices on oil-importing and exporting countries, Asteriou, Dimitras, and Lendewig (2013) observed that the impact was higher for countries importing crude oil than countries exporting it and that the relationship between oil price and stock markets was more robust than between various interest rates – both in the short and long-runs. Imarhiabel (2010) also examined the effect of crude oil prices on the prices of stocks of select major oil-producing and consuming countries such as Mexico, Russia, Saudi Arabia, India, China, and the United States, and detected that stock prices were affected by both oil prices and currency exchange rates. Further, a time-series study of almost three decades by Thorbecke (2019) highlighted that the US stock markets got negatively affected by shocks in oil price during 1990-2007, but after that, they were positively affected during 2010 to 2018 indicating a change in nature of the relation. This finding, according to the author was explained by the rise of shale oil production and the changed structure of US economy – stocks in many sectors that were harmed by oil price increases before the Shale revolution benefited in the latter period.

Even for India, the relationship between the two markets has been negative according to most studies. A study by Rai and Bairagi (2014) showed a significant correlation between a crude oil price change and Bombay Stock Exchange (BSE) Sensex for the period 2003 to 2012. Another study by Sathyanarayana et al. (2018) spoke of a positive, significant, and direct relationship between crude oil and BSE Sensex, with an increase in oil price leading to an increase in share market price. Fluctuations in crude oil price return exerted a significant impact on the volatility of stock market returns in India and such volatility spillovers were stronger following the global financial crisis (Anand et al., 2014).

But there have been exceptions. According to Chittendi (2012), volatile stock prices did not necessarily have a significant impact on oil price volatility and there was no long-run equilibrium relationship between international crude oil price and the Indian stock market during 2003 to 2011, although such a relation was observed during 2008-2011 (Ghosh and Kanjilal, 2016). Surprisingly, oil demand shocks, but not supply shocks, affected stock returns in India and its volatility, despite the fact that policy uncertainty could lead to negative returns and increased volatility (Anand et al., 2021).

Despite being a vastly studied topic, the precise relationship between crude oil price volatility and stock prices and the contagion effect thereof has not been stated with certainty. This has prompted a new approach to study the two markets i.e., to take into consideration industry-specific stock prices. The widely held view is that the sectoral segregation of stock market indices is necessary to gain a deeper knowledge of the impact of crude oil price fluctuations.

However, even in this regard, there have been not many studies in the Indian context. Studies exist for other countries, such as the US, Europe, and China. A study by Degiannakis et al. (2013) highlights the importance of the sectoral division of the stock market with regard to various industries as an important determinant in determining the nature of the association between prices of international crude oil and the stock market. They examine equity returns of 10 European industrial sectoral indices and their linkages with oil price changes via the Diag-VECH GARCH model and conclude that relationships are industry-specific. Another study on the relationship of European sectoral stocks with crude oil prices is found to be asymmetric (Arouri, 2011) and strongly varying across sectors. While Automobiles and parts, Financials, Food and Beverages, and Health care show a negative relationship, Oil and Gas show a positive relationship.

In another study by Thorbecke (2019), a positive relationship between crude oil price volatility and stock prices were seen for industries that acted as an input to the energy sector, such as industrial machinery and marine transport and industries in the oil supply chain (petrochemicals). Kang et al. (2017) concluded that the index for the oil and gas industry responded negatively to negative supply-side shocks and positively to positive aggregate demand shocks for the US.

It was also found that stock prices of manufacturing, chemical, medical, food, transportation, computer, real estate, and general services responded negatively to a rise in oil prices, whereas the results were indeterminate for stock prices of engineering, electricity, and financial sectors by using 56 firm-level stocks of the US (Narayan and Sharma, 2011). In one interesting time-series study by Singhal and Ghosh (2016), the relation of seven industry-specific sectoral stock prices of BSE with crude oil prices was examined and significant empirical evidence was obtained.

Yet in another study, Rajan and Lourthuraj (2020) have tried to understand the impact of crude oil price on the automotive sector and companies’ performances. Jambotkar and Anjana (2018) also through an empirical analysis studied the combined effects of macro-economic variables, including crude oil prices on selected National Stock Exchange (NSE) sectoral indices and found significant results. A recent paper by Fang and Egan (2018) investigated the contagion effects using extreme positive and negative returns and the multinomial logit model (MNL) for 10 Chinese stock sectoral indices. The theory of extreme value has been used the least to understand the oil price spill over on sectoral stock prices in the case of Indian stock markets. It was used only in a few other countries and other fields like Horvath et al. (2018) and Chan-Lau et al. (2012). In addition to this, the literature shows that very few studies exist on the impact of crude oil prices on cross-market linkage i.e., inter-sectoral linkage for extreme returns in crude oil prices for India’s stock markets.

Hence, a study of sectoral stock price indices and an attempt to measure inter-sectoral linkages are key to understanding the nature of the relationship between oil prices and industry-specific sectoral stock markets. This paper is a step in that direction.

II.2 Stylised Facts

The Indian stock market has grown significantly in the last two decades. The number of listed companies in the NSE is more than 1900 while its benchmark index, Nifty comprises 50 companies. The NSE also has many sectoral and thematic indices. Similarly, BSE’s Sensex is a weighted stock market index of 30 well-established listed companies. The BSE is among the world’s 10 largest exchanges in terms of the cumulative market capitalisation of all companies listed on its platform, as per the latest data available from the World Federation of Exchanges. The NSE has maintained the position of the largest derivatives exchange during 2019 and 2020 in terms of the number of contracts traded.

The BSE has the largest number of listed companies in the world (in the case of equities and debt). BSE is also the fastest exchange in the world with a median response time to trade of 6 microseconds. The NSE was by far the largest exchange in terms of stock index options trading, with over 1.85 billion contracts traded in H1 2019.

The average daily turnover in NSE was ₹57,677 crore and market capitalisation was ₹2,55,68,863 crore as on end-May 2022 and for BSE, the average daily turnover was ₹4,192.1 crore and the market capitalisation was at ₹2,57,78,368 crore in the same period. The stock market capitalisation to GDP ratio for BSE has improved significantly from 24 per cent in 1992-93 to 104.9 per cent in 2020-21.

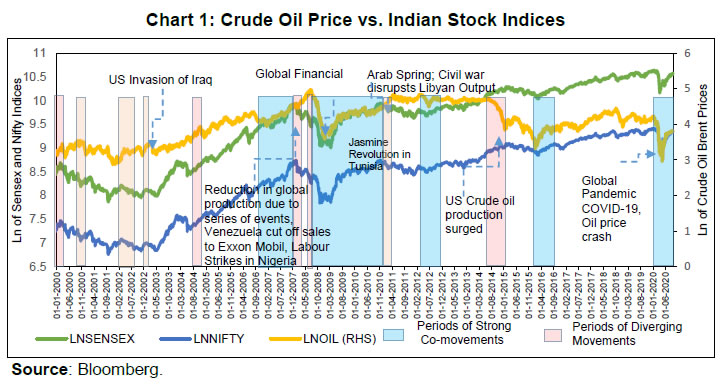

Apart from these milestones, the co-movement of Indian stock indices with global crude oil price (Brent) and these indices getting affected by major global events make it even more necessary to study the relationship between these indices and global crude oil price (Chart 1).

The contagion impact of global crude oil price on stock indices at the sectoral level is also backed by theory. There are two prominent theories supporting the linkage of international crude oil price movements and sectoral/industry-specific trends in stock indices. The first one, the channel of Expected Cash Flows states that the rise in oil prices leads to a rise in the cost of production, which in turn can reduce profit margins and hence cash flows (Dadashi et al., 2015). Theoretically, oil marketing, paints, synthetic rubber (tires), and the aviation industry’s input costs might rise due to a surge in crude oil price and their stock prices fall with rise in global crude oil price. Similarly, oil production and exploration companies may profit from a rise in crude oil prices and their stock prices may rise. The second theory of Discounted Future Cash Flows says that high oil prices can lead to inflationary expectations and hence rise in the interest rate, ultimately leading to higher borrowing costs.

The ultimate response of stock prices to crude oil price shocks, however, would depend upon whether the company is oil-producing or consuming. More importantly, the input-output coefficient of that sector would determine the responsiveness of its stock to oil price shocks. The volatility in oil prices can affect the operating costs of firms – both oil-producing and consuming and hit their earnings. Similarly, the profit and dividends of firms that use oil as inputs – direct or indirect, are bound to be impacted by volatility in oil prices. Likewise, the volatility in oil prices for an oil-importing or exporting market will differ widely. An upward movement in oil prices, while increasing risk and uncertainty in oil-importing markets, will increase market returns for an oil-exporting market. With a view to exploring these aspects of the behaviour of oil price movements on sectoral stock indices, 10 sectoral stock indices from BSE/NSE have been mapped against the input-output coefficient of India (MOSPI, 2012) taking petroleum products as the input. The input-output coefficients2 across eight sectors were estimated (Chart 2).

The higher input-output coefficients for Oil and Gas, and Basic Materials are on expected lines since the input intensity of petroleum products in these sectors is higher than in other sectors, such as IT and Financial Services. However, a broadly similar returns pattern can be observed across all stock sectors as well as Brent crude returns despite higher volatility in crude returns. All the 10 stock sector returns shared a statistically significant and positive correlation with Brent crude returns ranging between 0.11 to 0.20, indicative of the presence of contagion effect from extreme changes in global crude oil prices (Chart 3). Excessive volatility in oil price can affect expected earnings even for firms that are not related to oil directly thereby affecting equity prices.

III.1 Data and Preliminary Analysis

The time range for the paper is almost a decade and a half (14 years), from January 01, 2007 to December 08, 2020. The period has been chosen keeping in mind two aspects: a) the availability of data on most sectoral indices and b) the occurrence of two defining global crises of the century – the global financial crisis of 2008 and COVID-19 induced-recession of 2020. The data used are high-frequency daily data.

Most of India’s crude oil imports are from the OPEC countries and Brent is their benchmark index. Moreover, Brent is highly correlated with West Texas Intermediate (WTI). Hence, daily data on International crude oil prices (Brent) has been taken from Bloomberg. Sources of stock indices are Bloomberg and NSE and BSE websites. The Nominal Exchange rate (USD/INR) is obtained from RBI and the Financial Benchmarks of India Private Ltd. (FBIL). Data on the long-term interest rate (G-Sec 10-year yield) is collected from Bloomberg. The 10 sectoral stock indices used in the study are – Capital Goods (BSETCG), Consumer Durables (BSETCD), Basic Materials (BSESPBSBMIP), Oil and Gas (BSEOIL), Auto (NSEAUTO), Information technology (NSEIT), FMCG (NSEFMCG), Metal (NSEMETAL), Financial Services (NSEFIN) and Commodities (NSECMD). The rationale for the choice of above mentioned 10 sectors is based on their importance to the economy, extreme returns, and input-output coefficients (Chart 3); and weights in stock exchanges (market capitalisation) (Chart 4).

发表回复