Preparing to buy a house in six steps

Shopping for a house can be stressful for anyone, but these tips from Wells Fargo Home Lending can help ensure a successful homebuying experience.

Buying a home can challenge anyone’s patience, especially during spring and summer — typically the busiest time of the year, when competition can be fierce.

Still, by doing your homework, learning the market, and following a few basic steps to fine-tune your financial health, you can boost your chances of homeownership success.

Homeowner Chiquita Millender said she brought rookie enthusiasm to her first homebuying experience, but quickly learned it took more than that to succeed. Millender had student loans and other debt problems from college that had hurt her credit, and she and her husband couldn’t afford the house they wanted in the Atlanta area based on his income alone.

“I got so discouraged I wanted to quit,” said the 31-year-old restaurant manager and Wells Fargo customer. “Finally, though, I told myself to be a big girl and start again.”

With help from Wells Fargo, Millender put herself on a disciplined financial plan, reduced her debt, improved her debt-to-income ratio, and saved enough for a down payment. Her credit score rose about 200 points. Eventually, she and her husband found the home of their dreams and were approved for $150,000 more in financing than they had initially sought.

“Homeownership is something I appreciate so much,” she said. “It’s definitely an accomplishment I’m proud of. I was the first in my family to go to college and the first to buy a home. Now I can teach my sisters and brothers, even my mother, how to attain homeownership. It really feels great.”

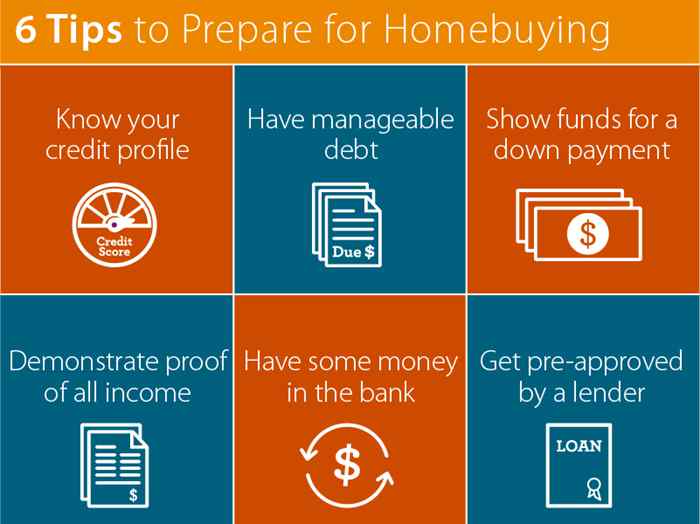

Six tips for a successful homebuying experience

Before scrolling through listings and sharpening your negotiation skills, potential homebuyers need to take some important preliminary steps, said Michael DeVito, head of Wells Fargo Home Lending.

“When buying a home, it helps to be prepared — including understanding what you can afford,” he said. “First-time homebuyers are often surprised to learn about all of the programs in place to help them with the purchase process. Talk to an expert and follow these key steps to make the path to homeownership a great experience.”

Read text version

- Know your credit: Your credit report holds detailed information about your past use of credit. That data then gets calculated into a number representing your creditworthiness — your credit score. Once a year, you may obtain a free copy of your credit report from each of the three credit reporting companies at annualcreditreport.com, the official site for free credit reports. Wells Fargo also provides online and mobile customers free access to their FICO® Credit Score.

- Manage your debt: Your debt-to-income ratio can also play a key role when buying a home. Try to keep your total debt level at or below 36 percent of your gross monthly income, allowing for a potential new mortgage payment.

- Have cash available for a down payment: Many people believe you need 20 percent of the home purchase price for a down payment, but that is no longer reality. Some programs allow qualified buyers to put down as little as 3 percent. Certain community initiatives, like Wells Fargo’s NeighborhoodLIFT® program, offer down payment assistance.

- Demonstrate proof of income: Home mortgage financing programs are available for a range of incomes. The key is demonstrating your ability to repay the loan. Lenders will review your income history and require current W-2s, tax returns, or similar documentation.

- Have a rainy day fund: Lenders want to see that you have savings or a cushion to handle the unexpected expenses that come with homeownership, such as a leaky roof or failing appliance.

- Get preapproved: Getting preapproved is a good way to understand what kind of home loan product or program you may qualify for and may help you negotiate price against competing offers.

Additionally, there are other resources that may be available to prospective homebuyers through their banks. Wells Fargo customers, for example, may qualify for the yourFirst MortgageSM program, which offers financial education and housing counseling to help guide them through the buying process. Wells Fargo also provides online and mobile customers a number of homebuying tools, including a debt-to-income calculator.

Taking on the competition

Homebuying is a lot tougher than many people realize — you have to do your homework and be prepared for whatever is going on in the marketplace, because “it’s a whole new real estate world out there,” said Rachel Hartman in an article for the National Association of Realtors®.

Homebuyers may encounter a range of hurdles, including bidding wars, all-cash offers, dubious home staging, and sketchy online promotions, she said.

“You will face an onslaught of tough competition and more that will require you to hone your homebuying skills more than ever,” said Hartman. “But knowing what awaits you is half the battle.”

发表回复